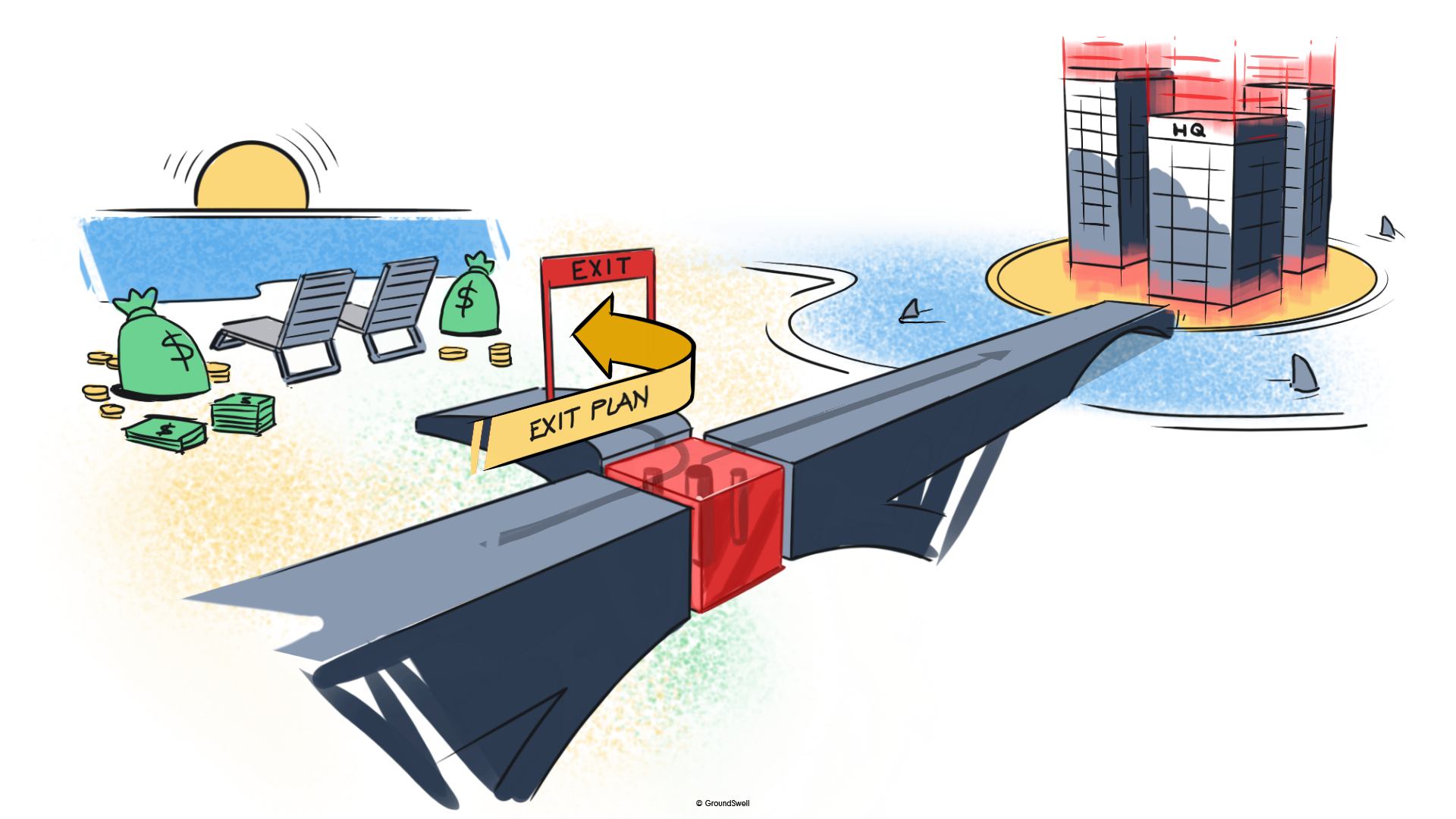

Are you looking to sell your business or transition it to a family member and retire? And are you counting on that asset to fund your retirement? If so you may have some real issues to address.

A survey1 of small businesses in the United States revealed that 54% intend to retire in the next 10 years, but 72% don’t have an exit plan. This will create a succession crisis.

- Boomer business owners will sell or bequeath $10 trillion worth of assets over the next two decades.

- These assets are held in more than 12 million privately-owned businesses.

- More than 70% of these companies are expected to change hands.

Strong Fundamentals Are a Competitive Advantage

An oversupply of sellers creates a competitive environment which drives down business valuations. A company’s ability to sell at an attractive valuation will depend on its fundamentals and competitive advantage.

If you’re interested in learning more about successfully transitioning your business, we’re here to help.

“You helped me develop a sound plan we executed together and I got much higher sale price that I ever expected.”

-Dan C.

GroundSwell’s Business Ownership PlatformSM provides the people and tools to create more time, money, and control in your business.

Schedule a call to learn more.