Investing in private equity funds is expensive. If you add up the management fees and carry the typical limited partner pays, about 40% of their total investment goes to their general partner.

Depending on the gross returns of a fund, that percent often translates to a 50% plus difference in gross to net returns.

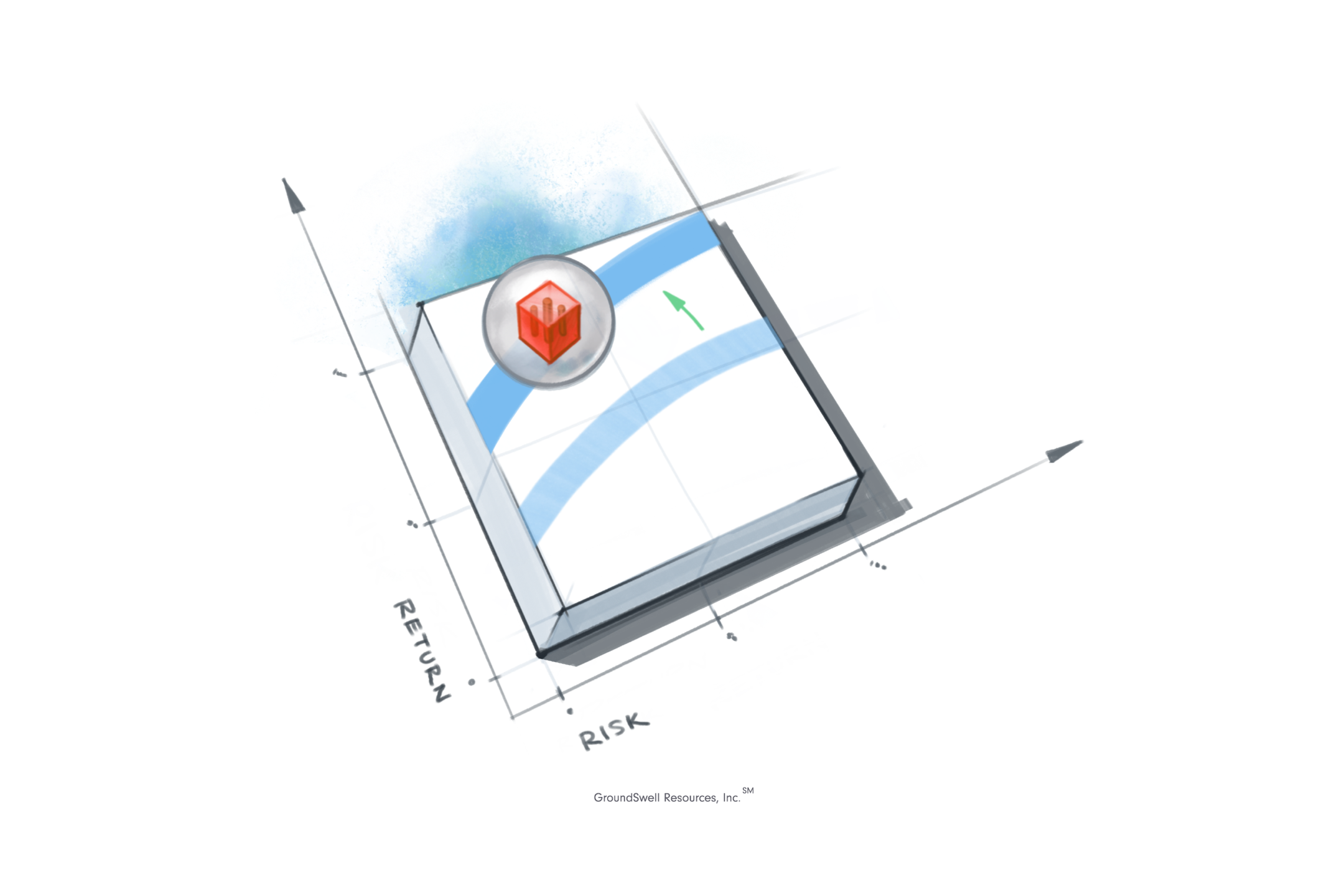

GroundSwellSM believes investors should be able to invest in developed organizations with a strong growth plan and capable and aligned management teams without overpaying. That translates to healthy investment returns with lowered risk; we call that Organizational AlphaSM:

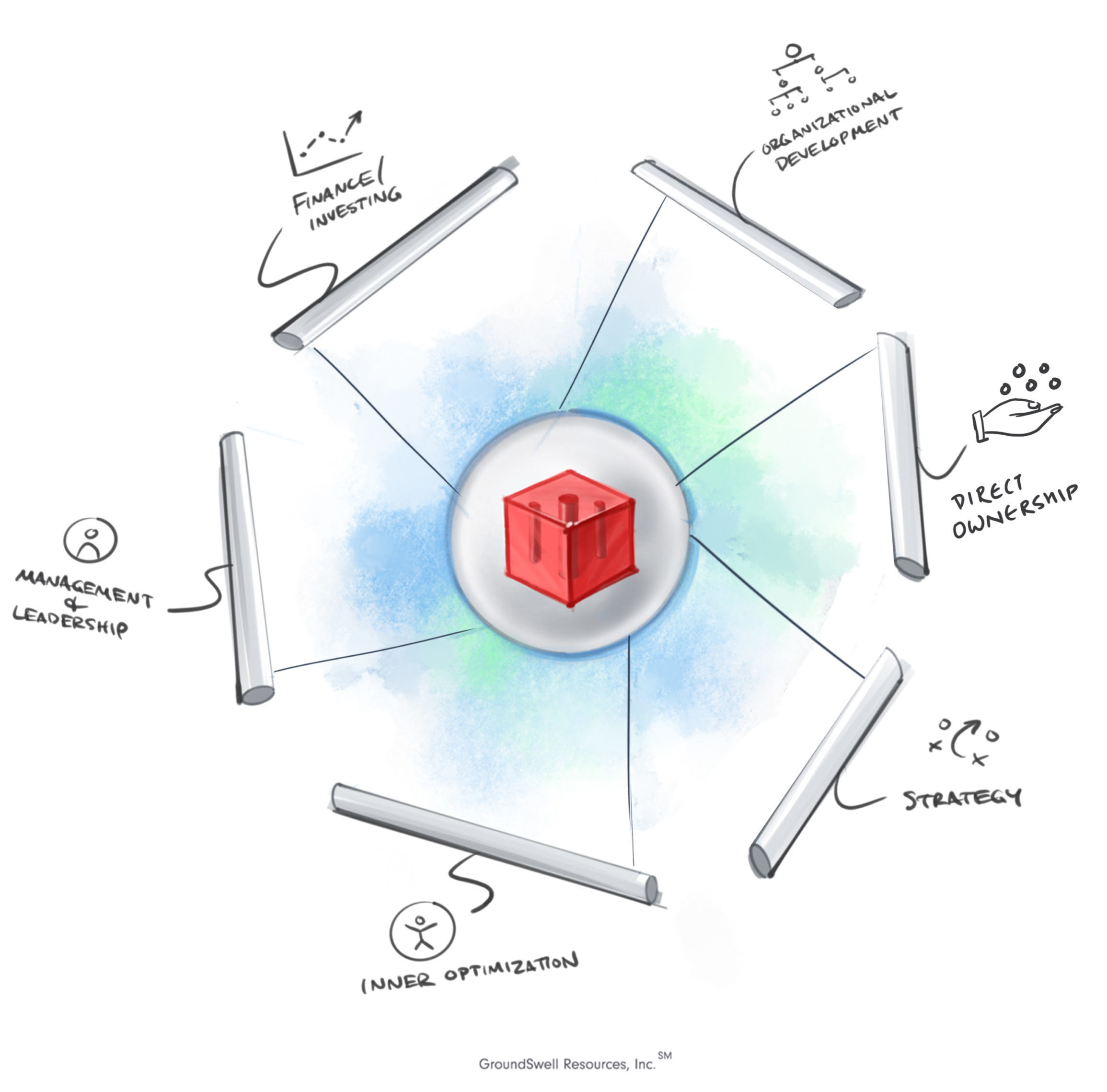

GroundSwellSM has researched and documented the critical systemic causes of organizational success and implemented them into our Direct Ownership PlatformSM:

Direct Ownership Platform℠

We’re out to improve the way investors invest, organizations are built, how managers and leaders are recruited and trained and how individuals and organizations leverage technology and automation to maximize efficiency and increase productivity.

Visit our key frameworks page to learn more about our Direct Ownership PlatformSM.