Capital

GroundSwellSM builds long-term partnerships and invests in select companies committed to long-term organizational and management development.

Capital

GroundSwellSM builds long-term partnerships and invests in select companies committed to long-term organizational and management development.

Why our investment process is different

You’ve probably experienced investment proposals and business partners that don’t meet your expectations. We’ve created an investment process that ensures you get the valuation, capital and partner you need and deserve. Our Business Ownership PlatformSM ensures we only build and invest in businesses when we have mutually aligned long-term goals. It also ensures our respective roles in achieving those goals are crystal clear.

When investing capital, GroundSwellSM “de-risks” our relationship with you before we invest with our rigorous yet efficient onboarding process.

We also play an integral part of your long-term team after our investment.

Assess

Offer

Valuation Bridge PlanSM

Capital

Assess

In less than thirty minutes our surveys clearly diagnose exactly where your company is today and what needs to be done to maximize your valuation.

Offer

Valuation Bridge PlanSM

Capital

Valuation Bridge PlanSM

Curious how our Valuation Bridge PlanSM works?

Download the guide

By submitting this form, you agree to

GroundSwell's Privacy Notice

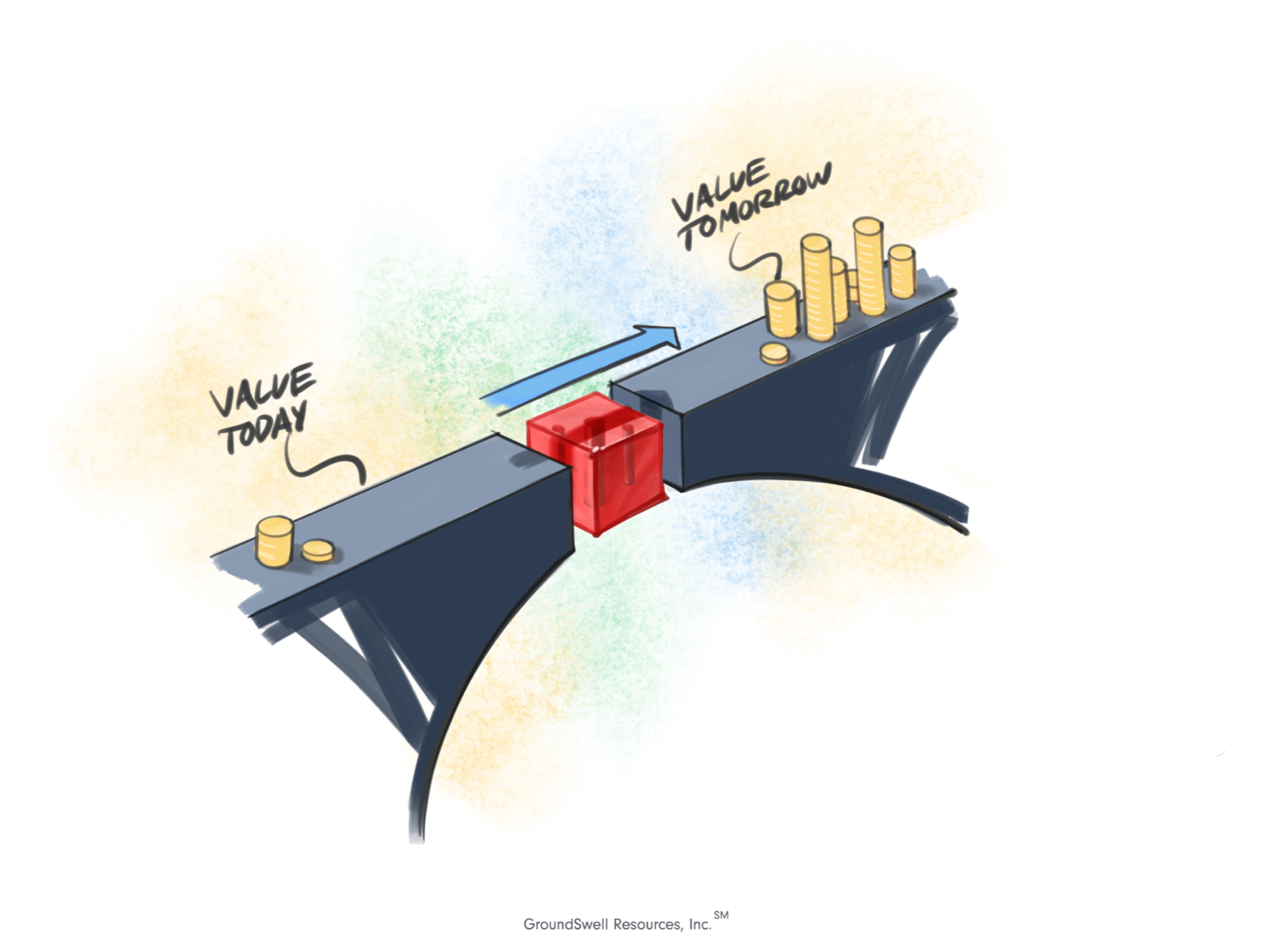

Are you ready for the next phase in your life after business ownership but not sure how to get there? Do you have access to capital but it’s too expensive? Or are you struggling to get the capital you need? Our Valuation Bridge PlanSM provides a clear path to address those key issues.

By submitting this form, you agree to

GroundSwell's Privacy Notice

Who we work with

We target investments in profitable companies with $3 to $30 million in revenue. Our investment size is typically $500,000 to $3 million but we can investment up to $25 million.

Valuation you deserve

If our initial offer isn’t what you want, we’ll work with you to get it there.

Raising money or selling your business? The one question to ask yourself

Do you know the question? Curious?

Download the guide

You’ve spent years building your business. It’s truly your baby. You’re the boss. But times change and so do your goals and aspirations. Thinking about bringing on an investment partner raises key questions about your business and your role in it. But before you start the process ask yourself one key question. It’s a straightforward question to ask but tough to answer. But you’ll know if you’re ready for outside investment once you have. Download our guide now to find out more.

Download the guide

By submitting this form, you agree to

GroundSwell's Privacy Notice

“GroundSwellSM was a better long-term partner than I could have ever imagined. We worked together in the trenches to an incredibly successful exit versus them just telling me what do at board meetings.”

Carli S.